News

Assisted Living Facility Costs as Tax Deductions

Since it’s tax season once again, many caregivers of our clients who are residents of an assisted living facility inquire about the tax deductibility of assisted living costs. The IRS provides rules for deducting certain qualified long-term care costs as medical expenses. Normally, the costs of nursing home care should be deductible, but the status of Assisted Living Facility (ALF) costs has not been as clear.

The Five Movements of the Human Body and What They Reveal About Aging, Loss, and Long-Term Care

As you may know, before law school, after I landed in Philadelphia, I made my living as a personal fitness trainer. My career in fitness began many years earlier – until my freshman year in college, I never really exercised. That all changed when a girl I was dating broke my heart. I was so despondent I couldn’t sleep, couldn’t eat. I just sat in my dorm room. One lonely afternoon, I did some pushups. Then some air squats Then some jumping jacks. That moment catalyzed my interest. The next summer, I became a certified personal trainer and worked in [...]

State of the Firm

As we come to the end of a meaningful and productive year, we want to thank you for your continued trust in our Elder Care Law Firm. We value our relationship with each of you, and we look forward to an even better 2026. I would like to take a few moments to reflect on the past year and update you on Rothkoff Law Group.

Paying for Memory Care: Medicaid Planning for Dementia Patients in PA & NJ

When a loved one is diagnosed with dementia, families in the Philadelphia metro area are suddenly faced with more than medical and emotional decisions. The financial reality of long-term memory care can be overwhelming. Memory care facilities often cost between $8,000 and $12,000 per month, expenses that can quickly drain savings built over a lifetime. Medicaid can play an important role in covering these costs, but many families are caught off guard by a critical detail: Pennsylvania and New Jersey handle Medicaid coverage for memory care very differently. What may be covered on one side of the Delaware River may [...]

Coordinating Veterans Benefits with Medicaid: A Comprehensive Guide for Families

Families caring for aging veterans face a unique challenge: navigating both veterans benefits and Medicaid for long-term care. Each program has its own rules, but using them together can save money and improve care options. At Rothkoff Law, we’ve helped hundreds of veteran families through this process. With the right plan, families can preserve assets while securing quality care—but small mistakes can cost tens of thousands of dollars. This guide explains key benefits, major differences, and planning strategies to help you make the most of both programs. Understanding Veterans Benefits for Long-Term Care Aid & Attendance (A&A) Benefits: What They [...]

8th Annual Rothkoff Law Elder Care Symposium

Attendees gathered at the 8th Annual Rothkoff Law Elder Care Symposium for a day of learning, insights, and community connection.

When Families Don’t Agree: Planning for a Loved One’s Care

When families clash over planning for a loved one’s care, clarity and preparation can help you create harmony and honor their wishes with confidence.

What Is A Medicaid-Compliant Annuity?

A Medicaid-compliant annuity can help protect assets while qualifying for long-term care benefits. Learn how it works and how it may reduce Medicaid penalties.

Five Tips for Choosing a Continuing Care Retirement Community

Get expert tips to confidently choose a Continuing Care Retirement Community that fits your lifestyle, care needs, and budget.

What Is VA Aid & Attendance? You Might Be Missing Out on This Benefit

This benefit helps veterans and surviving spouses pay for long-term care. Find out if you’re eligible and how to apply.

Can You Deduct Assisted Living Costs as Medical Expenses

Learn how to legally deduct assisted living costs as medical expenses. Understand IRS rules, eligibility requirements, and more.

How to Approach Someone with Dementia

How to approach someone with dementia using calm, respectful techniques that support safety and dignity in every interaction.

How to Handle a Medicaid Penalty Period

Facing a Medicaid penalty period? Learn what it means, how it’s calculated, and smart ways to manage care costs during the wait. Get expert guidance today.

New Jersey Property Tax Relief Programs

In New Jersey, there are now four programs that can provide New Jersey residents, if qualified, potential property tax relief. The property tax exemption and relief programs have different filing deadlines based on the specific program. The most prominent programs include the unified application (PAS-1) for seniors and individuals with disabilities (due October 31, 2025) and a year-round application period for veterans. The NJ Division of Taxation has made it easier for seniors and those receiving Social Security Disability in New Jersey to apply for Property Tax Relief with a new, simplified process. Their goal is to make the filing [...]

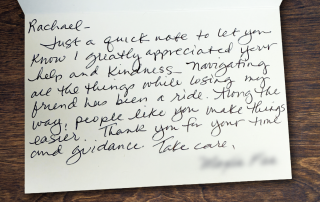

Compassion in Action: A Story from Our Client Services Team

Rothkoff Law Group’s mission is to be a resource for older adults, those living with disabilities, and the professionals working with them. As such, we encourage people to contact our office to ask a question or help them navigate the complex world of health care and chronic illness. We have both attorneys and non-attorneys who have decades of experience in elder care and elder law.